Hair Extensions Business Ideas USA

It is proven again in 2020 again, but the hair market is really a good market to be in. Crisis or not, the hair market in the United States did not only re-bounce, but it also kept her strength. For 2022 and further the data show a strong shift from in-store to online hair stores.

Where else do you find such a market to sell your hair extensions and other products? True, the purchase prices are increasing, and the shortage of lace in North Korea has disappointed many clients. It is never nice to say no to your client. But overall, the hair market in the united states has shown again to be very attractive and far from saturated. There is room for more trendy hair stores, especially online!.

You see opportunities? Read more about hair extensions business ideas USA.

Main developments for Hair Extensions Business Ideas United States of America:

Covid-19 has really had an impact on the hair market, there was a shortage of hair products where there was demand and the import of

- Consumers searched less for hair and hair related products in March 2020 and the following month

- North Korea, which is the biggest producer and distributor of lace products such as wigs, closure, and frontals, ceased all production

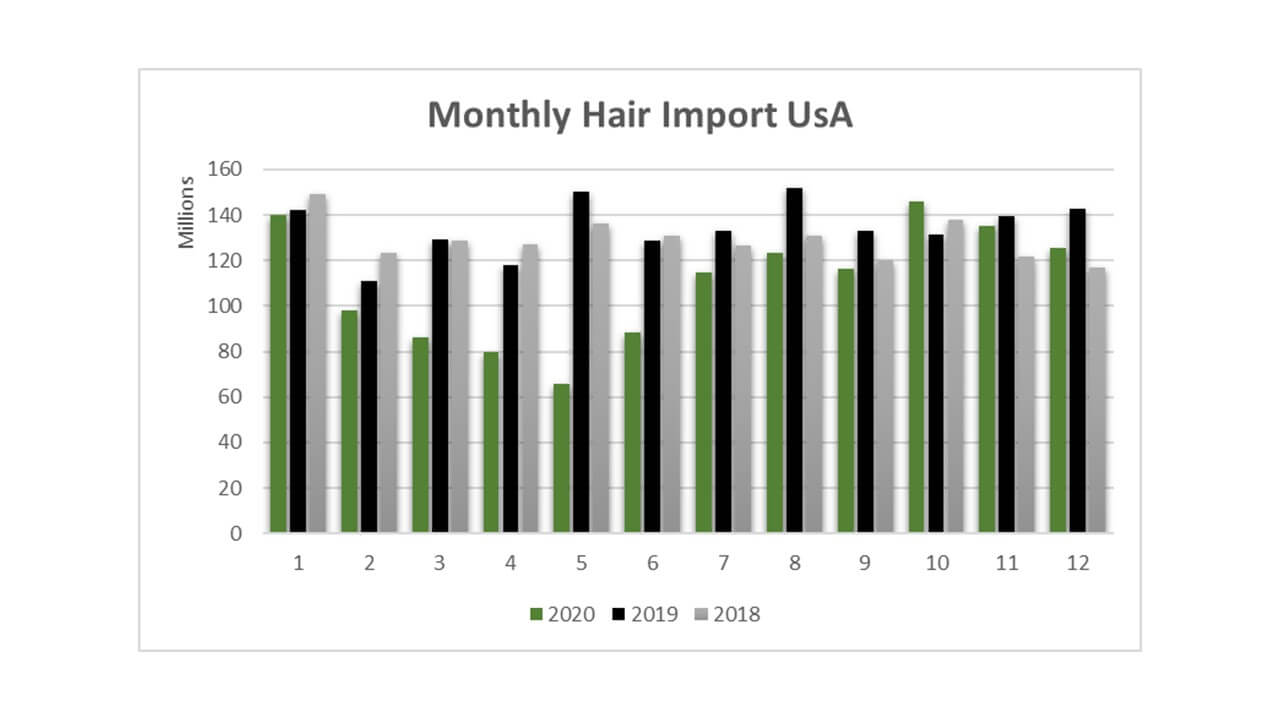

- Import from China dropped significantly as from January 2020, until August 2020 when it recovered till the 2018 levels.

How resilient is the hair market in the USA?

Thanks to Corona, we know there is no crystal boll that will help you to predict the future, but the evolution of the sales (imported hair) shows for years the hair market shows a stable growth. During the 2008 financial crisis, spending in the industry only fell slightly and fully bounced back by 2010 (A study from McKinsey)

The following signs may again prove that the beauty industry is once again relatively resilient. In China, the industry’s February 2020 sales fell up to 80 percent compared with 2019. In March 2020, the year-on-year decline was 20 percent—a rapid rebound. In a variety of markets, consumers reported they intended to spend less on beauty products in the near term, this explained the drop in Google search.

We can learn from the uptick in lipstick sales seen during the 2001 recession, Leonard Lauder of the cosmetics company coined the term “lipstick index” to describe this phenomenon. The principle is that people see lipstick as an affordable luxury, and sales therefore tend to stay strong, even in times of duress.

US hair market 2022, online growth!

In the years before Corona there was a 2 to 4 % year on year increase of the import of hair extensions and hair related products, like wigs, false beards, eyebrows and eyelashes, switches, and the like. The trade data shows a recovery of the drop in the first half of 2020. In 2021 there will be an acceleration. Overall, instore, and online the 4 % year on year growth will continue, but thanks to the shift from in-store to online the online sales of hair and hair products will significantly increase.

One substantial impact of Corona is a shift from consumers buying hair online instead in-store. This shift is estimated by McKinsey on 20 to 30 percent. Pre-COVID-19 trends on online sales will likely accelerate, with direct-to-consumer e-commerce, such as brands’ websites, shoppable social-media platforms, and marketplaces becoming more important. Consumers indicate they are likely to increase their online engagement and spending. This means hair and beauty store will need to prioritize digital channels to capture and convert the attention of existing and new customers.

Start Selling Your Hair on a Shopify Online Store